Predicting 2023 rent increases by quarter:

In our 2022 rental recap report we noted that the prediction for rent increases in 2023 would be in the range of 3-6% across the board. Recent data pulled from Q1 2023, suggest that several major cities fell under that assumption with some of the largest rent increases occurring in Halifax (6.08%), Montreal (+5.79%), Waterloo (+5.5%), and Quebec City (4.7%). There were a few major markets which have decreased in Q1, such as Vancouver (-8.29%), Kitchener (-5.45%), Toronto (-3.03%) and Calgary (-2.22%). Although these markets were down, we predict that Q2 will see a steady growth in rent numbers across the board as there is a shift in moving habits during the warmer months to come.

| Cities | Q1 | Q2 |

|---|---|---|

| Toronto | 2.16% | 4.55% |

| Hamilton | 2.03% | 1.53% |

| Mississauga | 1.94% | 3.46% |

| Kitchener | 4.28% | -1.26% |

| Waterloo | -0.14% | 3.36% |

| Guelph | 5.29% | 3.82% |

| Montreal | 5.86% | -3.78% |

| Quebec City | -13.73% | 9.97% |

| Vancouver | -5.06% | 3.48% |

| Calgary | -1.51% | 1.62% |

| Edmonton | -0.31% | 1.40% |

| Winnipeg | -0.60% | 1.10% |

| Halifax | 1.37% | 2.36% |

| TOTAL AVERAGE | 0.12% | 2.43% |

The market has mixed signals on rent increases:

The rental market in the first quarter of 2023 has shown some mixed signals. On the one hand, prices in most markets appear to be slowly increasing since the last quarter of 2022 and the average days on market for listings has decreased, however there are still a few markets that haven’t recovered back to Q3 2022 rental prices (Toronto, Vancouver, Kitchener, Calgary).

Bank of Canada news affecting rental increases:

Many investors and landlords may have felt a calm wave with the latest Bank of Canada rate pause. The fear of having to plan for increasing rising mortgage rates (cost) seems to have slightly subsided and it has been reflected in the listing prices not gaining significant traction (growth still in the single digits across most major markets).

However, the demand for rental housing is still substantial as the days on market indicator tells us. We believe due to continually tight rental supply we are going to end up seeing prices rise once again in Q2 and beyond. We’re on our way out of the seasonally low phase of the rental market so more renters have already begun their search.

By the next quarter, if we don’t see a greater supply to meet demand, we expect to see more resurgence in rental rates across the board.

Cities to Watch / Halifax, Peterbrough, Kingston:

Halifax continues to exhibit strong demand with 1 bedroom rent up 13% since last quarter and 3 bedrooms up 6.1% with only 2 bedrooms seeing stabilization with 2.5% decrease. Halifax is a key location to watch as the city is putting forth interesting short-term rental regulations that are much more short-term rental friendly than other cities across the country. For example, instead of a blanket law that covers the entire city, they are planning zoning rules for commercial/mixed use and residential properties. If you are in a residential zone, you will be required to live in the home you intend to operate your short-term rental from. This is similar to places like Toronto, however, there is no 180 day restriction on the number of nights you can rent out for. 70% of the short-term rental listings are currently in residential areas so there may be a small reduction as some move back into the long-term rental space. However, just as in Toronto, when similar but more restrictive laws were passed on short-term rentals, the long term rental market will quickly absorb any new inventory and tight supply will continue to put pressure on price. How the city outlines zoning and the impact this will have on the valuation of homes will be interesting to watch. Peterborough and Kingston have been experiencing the lowest vacancy rates in Ontario as more families may be looking for more affordable towns that are not too far from Toronto. Peterborough’s purpose rental vacancy currently sits at 1.1% and Kingston is at 1.2% vacancy according to CHMC. Kingston saw rents rise across all segments with 2 bedrooms leading at 11.1% since last quarter. Peterborough had some stabilization but continued seeing rises in 1 bedroom rents with 2.9% increase. Both of these cities are university towns with a softened housing market but continually high rents which may be opportunities for investors looking to stay in Ontario.

income to rent

income to rent

income to rent

income to rent

income to rent

income to rent

| City | Individual Affordability | Affordability Ratio | Household Affordability | Affordability Ratio |

|---|---|---|---|---|

| Toronto | 113% | 0.9 : 1 | 56% | 1.8 : 1 |

| Vancouver | 111% | 0.9 : 1 | 61% | 1.6 : 1 |

| Kitchener/Waterloo/Cambridge | 87% | 1.1 : 1 | 44% | 2.3 : 1 |

| Victoria | 83% | 1.2 : 1 | 49% | 2 : 1 |

| Abbotsford | 79% | 1.3 : 1 | 44% | 2.3 : 1 |

| Kelowna | 80% | 1.2 : 1 | 46% | 2.2 : 1 |

| Niagara/St. Catherines | 72% | 1.4 : 1 | 43% | 2.3 : 1 |

| Guelph | 74% | 1.3 : 1 | 44% | 2.3 : 1 |

| Halifax | 76% | 1.3 : 1 | 43% | 2.3 : 1 |

| Hamilton | 73% | 1.4 : 1 | 39% | 2.6 : 1 |

| Peterborough | 73% | 1.4 : 1 | 48% | 2.1 : 1 |

| Montreal | 70% | 1.4 : 1 | 40% | 2.5 : 1 |

| Ottawa | 70% | 1.4 : 1 | 33% | 3.1 : 1 |

| Belleville | 75% | 1.3 : 1 | 43% | 2.3 : 1 |

| Kingston | 68% | 1.5 : 1 | 39% | 2.5 : 1 |

| Calgary | 67% | 1.5 : 1 | 34% | 3 : 1 |

| London | 64% | 1.6 : 1 | 42% | 2.4 : 1 |

| Brantford | 77% | 1.3 : 1 | 43% | 2.3 : 1 |

| Sarnia | 58% | 1.7 : 1 | 41% | 2.5 : 1 |

| Sault Ste. Marie | 60% | 1.7 : 1 | 31% | 3.3 : 1 |

| Windsor | 60% | 1.7 : 1 | 36% | 2.8 : 1 |

| Moncton | 56% | 1.8 : 1 | 34% | 2.9 : 1 |

| Trois-Rivières | 40% | 2.5 : 1 | 38% | 2.6 : 1 |

| Winnipeg | 50% | 2 : 1 | 29% | 3.4 : 1 |

| Sudbury | 57% | 1.8 : 1 | 36% | 2.8 : 1 |

| Sherbrooke | 40% | 2.5 : 1 | 32% | 3.1 : 1 |

| Edmonton | 48% | 2.1 : 1 | 26% | 3.8 : 1 |

| Thunder Bay | 54% | 1.9 : 1 | 29% | 3.4 : 1 |

| Regina | 48% | 2.1 : 1 | 23% | 4.3 : 1 |

| Saskatoon | 45% | 2.2 : 1 | 27% | 3.7 : 1 |

Winnipeg, Edmonton, Thunder Bay, Regina, and Saskatoon rank as the most affordable cities while Toronto, Vancouver and Kitchener Waterloo rank as most unaffordable regions overall.

Individual Affordability

Since last month, we saw individual affordability in Toronto get slightly better to 113% of income, up from 118% and 123% in the previous months respectively. Signs that affordability is returning from its peak in major cities. Vancouver also brought back affordability now at 111% of income, from 124% last month.

Continuing on a trend from last month, In some smaller cities we saw **individual affordability** further erode such as in Abbotsford (-11%), Kelowna (-4.3%) in the west and Windsor (-6.24%), Moncton (-4.5%) in the east.

Household Affordability

In Toronto, household affordability also improved where household income is now 56% of income which is up from 74% of income last month. Vancouver experienced larger increases in household affordability bringing rent to 61% of income compared to last month’s 75%.

In some smaller cities we saw household affordability improve almost across the board with only slight declines in affordability in markets such as Peterborough, Sarnia and Trois-Rivières as families who need more space are moving in, generating more demand in those markets driving up rental rates.

| Cities | Forecasted Rent % Change (Q1 2023) | Actual Rent % Change (Q1 2023) |

|---|---|---|

| Toronto | 2.16% | -3.03% |

| Hamilton | 2.03% | 2.00% |

| Mississauga | 1.94% | 2.56% |

| Kitchener | 4.28% | -5.45% |

| Waterloo | -0.14% | 5.50% |

| Guelph | 5.29% | 3.57% |

| Montreal | 5.86% | 5.79% |

| Quebec City | -13.73% | 4.70% |

| Vancouver | -5.06% | -8.29% |

| Calgary | -1.51% | -2.22% |

| Edmonton | -0.31% | 0.00% |

| Winnipeg | -0.60% | 3.03% |

| Halifax | 1.37% | 6.08% |

| Province | Median Rent (Mar 2023) | Median Rent (Dec 2022) | Median Rent (Mar 2022) | Quarter-Over-Quarter Rent % Change |

Year-Over-Year Rent % Change |

|---|---|---|---|---|---|

| Alberta | $1,662 | $1,700 | $1,300 | -2.2% | 27.8% |

| British Columbia | $2,350 | $2,382 | $2,350 | -1.3% | 0.0% |

| Manitoba | $1,429 | $1,430 | $1,300 | -0.1% | 9.9% |

| New Brunswick | 1495 | $1,350 | $1,280 | 10.7% | 16.8% |

| Newfoundland | $1,275 | $1,472 | $1,250 | -13.4% | 2.0% |

| Nova Scotia | $1,750 | $1,815 | $1,695 | -3.6% | 3.2% |

| Northwest Territories | $2,200 | $1,750 | $1,628 | 25.7% | N/A |

| Ontario | $2,350 | $2,395 | $2,200 | -1.9% | 6.8% |

| Prince Edward Island | $1,800 | $1,612 | $1,550 | 11.7% | N/A |

| Quebec | $1,400 | $1,350 | $1,250 | 3.7% | 12.0% |

| Saskatchewan | $1,350 | $1,399 | $1,100 | -3.5% | 22.7% |

| Yukon | $1,675 | $2,100 | N/A | 0.00% | N/A |

| All Canada | $2,035 | $2,140 | $1,800 | -4.9% | 13.1% |

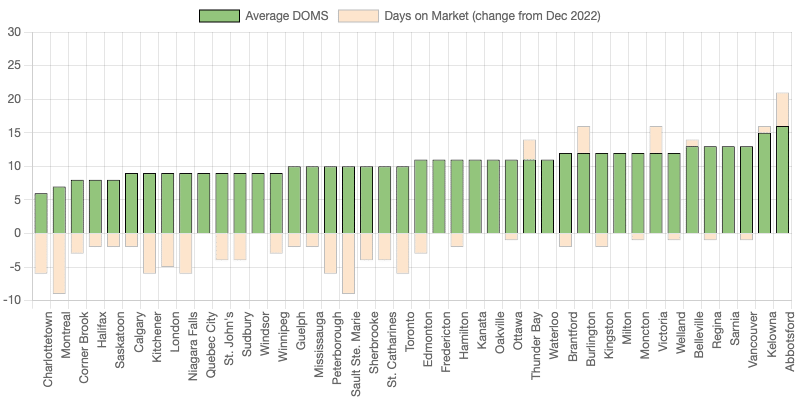

Markets across the country are continuing to see high demand for rental properties – which means relatively low average days-on-market (DOM). Overall, from last month we saw days on market increase for most of the cities across the country showing signs of a definite slowdown in the rental market – however still showing very low days on market overall (with 20 DOM being the highest average number). Only 10 cities of the 38 saw declines in DOM. The biggest change for fast renter turnover was in London which saw listing DOM down 7 days sooner than last month. Montreal on the other hand saw listings sitting for 7 days longer. In Ontario, Niagara Falls, Mississauga and Peterborough led the country with just under 10 DOM at 7 days, 10 and 10 days respectively. Heading east, Halifax and Moncton saw listings quickly rented within 12 days. The two most expensive markets of Toronto and Vancouver both took an average of 15 DOM. In the prairies, Saskatoon and Winnipeg saw steady demand at 10 DOM. With most markets taking 2 weeks or less, rentals listings continue to see high demand and quick turnover.

| City | Three Bedroom Median Rent | Last Quarter Rent (Jan 2023) | Last Year Rent (Mar 2022) | Month-Over-Month Rent % Change | Year-Over-Year Rent % Change |

|---|---|---|---|---|---|

| Abbotsford | 2500 | 2375 | N/A | ||

| Airdrie | 2300 | N/A | N/A | ||

| Barrie | 2600 | 2525 | N/A | ||

| Belleville | 2400 | 2425 | N/A | ||

| Brampton | 2900 | 2900 | 2600 | ||

| Brandon | 1312 | 1375 | N/A | ||

| Brantford | 2400 | 2445 | 2500 | ||

| Burlington | 3100 | 3000 | 3172 | ||

| Burnaby | 3100 | N/A | N/A | ||

| Calgary | 2200 | 2250 | 1850 | ||

| Charlottetown | 2300 | 2250 | N/A | ||

| Coquitlam | 3416 | N/A | N/A | ||

| Corner Brook* | 1200 | 1250 | N/A | ||

| Edmonton | 1700 | 1700 | 1550 | ||

| Etobicoke | 3100 | 3150 | 3265 | ||

| Fredericton | 1900 | 1740 | 1450 | ||

| Guelph | 2900 | 2800 | 2797 | ||

| Halifax | 2650 | 2498 | 2298 | ||

| Hamilton | 2550 | 2500 | 2600 | ||

| Kanata* | 2270 | 2278 | 2250 | ||

| Kelowna | 2800 | 2800 | 4700 | N/A | N/A |

| Kingston | 2500 | 2425 | 2600 | ||

| Kitchener | 2600 | 2750 | 2500 | ||

| Laval* | 2000 | 1950 | N/A | ||

| Lethbridge* | 1650 | 1550 | 1750 | ||

| London | 2400 | 2450 | 2472 | ||

| Markham | 2950 | 3100 | 2875 | ||

| Milton | 2900 | 2950 | 2650 | ||

| Mississauga | 3000 | 3000 | 2925 | ||

| Moncton | 1850 | 1800 | 1750 | ||

| Montreal | 2100 | 1985 | 1850 | ||

| Mount Pearl* | 1550 | 1700 | N/A | ||

| Nanaimo* | 2450 | N/A | N/A | ||

| Niagara Falls | 2300 | 2399 | 2300 | ||

| North Vancouver | 3838 | N/A | N/A | ||

| North York | 3200 | 3000 | 2848 | ||

| Oakville | 3300 | 3350 | 3200 | ||

| Oshawa | 2400 | 2600 | 2295 | ||

| Ottawa | 2395 | 2350 | 2300 | ||

| Peterborough | 2400 | 2600 | N/A | ||

| Quebec City | 1738 | 1660 | N/A | ||

| Regina | 1600 | 1500 | 1575 | ||

| Richmond | 3800 | N/A | N/A | ||

| Sarnia | 2300 | 2500 | N/A | ||

| Saskatoon | 1900 | 1600 | 1600 | ||

| Sault Ste. Marie | 1895 | 1800 | N/A | ||

| Scarborough | 2625 | 2902 | 2395 | ||

| Sherbrooke | 1500 | 1400 | N/A | ||

| St. Catharines | 2198 | 2250 | 1900 | ||

| St. John’s | 1750 | 1775 | 1300 | ||

| Sudbury* | 2188 | 2250 | N/A | ||

| Surrey | 3000 | 3000 | N/A | ||

| Thunder Bay | 1980 | 1800 | 1762 | ||

| Toronto | 3200 | 3300 | 3000 | ||

| Trois-Rivieres | 1299 | 1200 | N/A | ||

| Vancouver | 3650 | 3980 | 3600 | ||

| Vaughan | 3212 | 3275 | N/A | ||

| Victoria | 3250 | 3270 | N/A | ||

| Waterloo | 2875 | 2725 | 2550 | ||

| Welland | 2125 | 2150 | 2200 | ||

| Windsor | 1900 | 2000 | 1800 | ||

| Winnipeg | 1700 | 1650 | 1500 | ||

| Nepean | 2395 | 2275 | 2250 |

In the 3 Bedroom All category we’re seeing a higher ratio of declines as we saw in the 3 bedroom house category. Typically more affordable cities such as Quebec City (+31.7%), Peterborough (+4%), Sudbury (+5.9%), Belleville (+5.4%) are still experiencing increases due to more people possibly moving into the area to find larger, cheaper rent alternatives outside of the more expensive cities.

| City | Three Bedroom Median Rent |

Last Month Rent (Dec 2022) |

Last Year Rent (Dec 2021) |

Month-Over-Month Rent % Change |

Year-Over-Year Rent % Change |

|---|---|---|---|---|---|

| Abbotsford | 2500 | 2500 | N/A | ||

| Belleville | 2450 | 2400 | 2200 | ||

| Brampton | 2900 | 2995 | 2600 | ||

| Brandon* | 1460 | 1455 | N/A | ||

| Brantford | 2495 | 2498 | 2300 | ||

| Burlington | 3000 | 3100 | 3100 | ||

| Calgary | 2250 | 2295 | 1900 | ||

| Charlottetown | 2200 | 2200 | N/A | ||

| Corner Brook | 1262 | N/A | N/A | ||

| Edmonton | 1750 | 1800 | 1598 | ||

| Etobicoke* | 3250 | 3222 | 3198 | ||

| Fredericton* | 1650 | 2175 | 1800 | ||

| Guelph | 2900 | 2725 | N/A | ||

| Halifax | 2500 | 2500 | 2275 | ||

| Hamilton | 2500 | 2625 | 2500 | ||

| Kelowna | 2875 | 2975 | N/A | ||

| Kingston | 2500 | 2500 | 2500 | ||

| Kitchener | 2750 | 2800 | 2495 | ||

| Lethbridge | 1575 | 1500 | 1300 | ||

| London | 2473 | 2500 | 2372 | ||

| Markham | 3100 | 2995 | 2880 | ||

| Milton | 2912 | 3000 | 2750 | ||

| Mississauga | 3000 | 3148 | 2700 | ||

| Moncton | 1812 | 1900 | 1600 | ||

| Montreal | 2250 | 2374 | 2025 | ||

| Nepean | 2275 | 2300 | 2350 | ||

| Niagara Falls | 2400 | 2400 | 2299 | ||

| North York* | 3000 | 2999 | 2700 | ||

| Oakville | 3350 | 3400 | 3200 | ||

| Oshawa | 2600 | 2595 | 2365 | ||

| Ottawa | 2400 | 2400 | 2300 | ||

| Peterborough | 2800 | 2500 | 2275 | ||

| Quebec City* | 1900 | N/A | N/A | ||

| Regina | 1525 | 1600 | 1490 | ||

| Sarnia | 2550 | 2600 | |||

| Saskatoon | 1695 | 1850 | 1658 | ||

| Sault Ste. Marie | 1850 | 1750 | N/A | ||

| Scarborough | 3125 | 2899 | 2320 | ||

| Sherbrooke | 1725 | 1500 | N/A | ||

| St. Catharines | 2325 | 2300 | 2348 | ||

| St. John’s | 1800 | 2000 | N/A | N/A | |

| Sudbury | 2400 | 2350 | 1900 | ||

| Summerside | 2000 | N/A | N/A | ||

| Surrey | 3300 | 2950 | N/A | ||

| Thunder Bay | 1862 | 1800 | N/A | ||

| Toronto | 3398 | 4182 | 3270 | ||

| Vancouver | 3800 | 3980 | |||

| Vaughan | 3400 | 3495 | 3025 | ||

| Victoria | 3290 | 3800 | 2750 | ||

| Waterloo | 2797 | 3000 | 2750 | ||

| Welland | 2200 | 2198 | 2222 | ||

| Whitehorse | 2650 | 2100 | N/A | ||

| Windsor | 2100 | 2100 | 1950 | ||

| Winnipeg | 1650 | 1795 | 1500 |

Most cities continued to experience declines in the 3 bedroom rent category with Toronto (-18.7%) as one of the highest drops. In the west coast, Victoria (-13.4%) experienced a heavy dip in 3 bedroom home rents, coming down to just under $3,300 and Vancouver experienced (-4.5%) a decline to $3,800. In Ontario, we mostly see further rental declines and stabilization with a few outliers such as Guelph (+6.4%), Bellevile (+2.1%), Markham (+3.5%), Peterborough (+12%), Sault. St Marie (+5.7%) and Scarborough (+7.8%) experiencing smaller rent increases.

| City | Two Bedroom Median Rent |

Last Quarter Rent (Jan 2023) | Last Year Rent (Mar 2022) | Month-Over-Month Rent % Change |

Year-Over-Year Rent % Change |

|---|---|---|---|---|---|

| Abbotsford | $1,700 | $1,672 | $2,200 | ||

| Barrie | $1,850 | 1972 | N/A | ||

| Belleville | $1,950 | $2,090 | 1900 | N/A | |

| Brampton | $1,900 | $1,950 | $1,800 | N/A | |

| Brandon | $1,040 | $1,010 | N/A | ||

| Brantford | $1,896 | $1,899 | 2000 | ||

| Burlington | $2,550 | $2,800 | $2,298 | N/A | |

| Burnaby | $2,850 | $2,600 | N/A | ||

| Calgary | $1,700 | $1,700 | 1450 | ||

| Charlottetown | $1,800 | $1,800 | 1500 | ||

| Coquitlam | $2,250 | $1,900 | N/A | ||

| Edmonton | $1,300 | $1,378 | $1,250 | ||

| Etobicoke | $2,150 | $2,327 | $2,440 | ||

| Fredericton | $1,500 | $1,598 | $1,250 | ||

| Guelph | $2,122 | $2,200 | $1,395 | ||

| Halifax | $1,950 | $2,000 | 1695 | ||

| Hamilton | $1,950 | $2,000 | $1,995 | ||

| Kelowna | $2,100 | $2,175 | $1,650 | ||

| Kingston | $2,000 | $1,800 | $1,795 | ||

| Kitchener | $2,125 | $2,250 | $2,090 | ||

| Laval | $1,720 | $1,292 | $1,100 | N/A | N/A |

| Lethbridge | $1,372 | $1,225 | $1,200 | ||

| London | $1,795 | $1,850 | $1,798 | ||

| Markham | $1,850 | $2,000 | $2,200 | ||

| Milton | $2,000 | $2,100 | $2,450 | ||

| Mississauga | $2,100 | $2,300 | $2,235 | ||

| Moncton | $1,350 | $1,350 | $1,250 | ||

| Montreal | $1,600 | $1,800 | $1,650 | ||

| Mount Pearl | $1,100 | $1,100 | $875 | ||

| Niagara Falls | $1,800 | $1,800 | 1750 | ||

| North Bay | $1,875 | $1,600 | N/A | ||

| North Vancouver | $3,100 | 2938 | N/A | ||

| North York | $2,700 | $2,569 | $2,295 | N/A | |

| Oakville | $2,650 | $2,650 | 2450 | ||

| Oshawa | $1,850 | $1,900 | $1,895 | N/A | |

| Ottawa | $2,000 | $2,150 | $1,950 | ||

| Peterborough | $1,950 | $2,000 | $1,950 | ||

| Quebec City | $1,095 | 1195 | 965 | ||

| Regina | $1,250 | $1,200 | 1112 | ||

| Richmond | $2,625 | $2,200 | N/A | ||

| Sarnia | $1,650 | $1,699 | $1,222 | ||

| Saskatoon | $1,300 | 1400 | 1100 | N/A | |

| Sault Ste. Marie | $1,400 | $1,550 | N/A | ||

| Sherbrooke | $1,062 | $1,105 | N/A | ||

| St. Catharines | $1,900 | $1,935 | $1,675 | N/A | |

| St. John’s | $1,400 | 1575 | 1450 | ||

| Sudbury | $1,650 | $1,625 | $1,540 | N/A | |

| Surrey | $2,100 | $1,950 | $2,275 | ||

| Thunder Bay | $1,600 | 1550 | 1280 | ||

| Toronto | $2,650 | 2800 | 2482 | ||

| Trois-Rivieres | $1,150 | $1,100 | $750 | ||

| Vancouver | $3,000 | $3,295 | $2,850 | ||

| Vaughan | $2,499 | $2,650 | $2,145 | ||

| Victoria | $2,500 | $2,700 | $2,700 | ||

| Waterloo | $2,000 | $2,200 | $1,848 | ||

| Welland | $1,695 | $1,650 | $1,695 | ||

| Whitehorse | $2,200 | $2,350 | N/A | ||

| Windsor | $1,550 | $1,700 | $1,599 | ||

| Winnipeg | $1,400 | $1,295 | $1,350 |

The 2 Bedroom All category overall made more gains this month compared with 2 bedroom condos and apartments. Toronto (-5.5%) and Vancouver (-6.6%) continued with declines as other regions of Ontario and British Colombia has rents pushed up. Notably Belleville (+7.9%) and St. Catherines (+7.8%) experienced gains within Ontario. In the west coast, Calgary (+3%) saw modest increases along with Victoria (+3.8%) and Kelowna (+3.8%). This may be a sign that demand for larger units such as 2 bedroom townhouses or houses is increasing in the more affordable cities.

| City | Two Bedroom Median Rent |

Last Month Rent (Dec 2022) | Last Year Rent (Dec 2021) | Month-Over-Month Rent % Change | Year-Over-Year Rent % Change |

|---|---|---|---|---|---|

| Abbotsford | 1875 | 1900 | N/A | ||

| Belleville | 1800 | 1750 | 1600 | ||

| Brampton | 2122 | 1900 | 1918 | ||

| Brandon | 938 | 1000 | N/A | ||

| Brantford | 1850 | 1800 | N/A | ||

| Burlington | 2704 | 2832 | 2500 | ||

| Calgary | 1795 | 1800 | 1450 | ||

| Charlottetown | 1740 | 1595 | N/A | ||

| Edmonton | 1416 | 1400 | 1200 | ||

| Etobicoke | 2373 | N/A | N/A | ||

| Fredericton | 1500 | 1450 | N/A | ||

| Guelph | 2200 | 2350 | N/A | ||

| Halifax | 2000 | 1998 | 1850 | ||

| Hamilton | 1895 | 2150 | 1874 | ||

| Kelowna | 2200 | 2125 | 2124 | ||

| Kingston | 1800 | 1972 | 1725 | ||

| Kitchener | 2300 | 2200 | 1975 | ||

| Laval | 1292 | 1344 | 1598 | ||

| Lethbridge | 1225 | 1295 | 1099 | ||

| London | 1800 | 1999 | 1772 | ||

| Markham | 2200 | 2598 | N/A | ||

| Milton | 2000 | 2625 | 2300 | ||

| Mississauga | 2550 | 2750 | 2200 | ||

| Moncton | 1300 | 1250 | 1300 | ||

| Montreal | 1800 | 1675 | 1598 | ||

| Mount Pearl | 1300 | N/A | N/A | ||

| Nepean | 2000 | 1950 | 1850 | ||

| Niagara Falls | 1775 | 1645 | 1550 | ||

| North York | 2600 | 2742 | 2325 | ||

| Oakville | 2700 | 2700 | 2300 | ||

| Oshawa | 2016 | 2125 | 1858 | ||

| Ottawa | 2150 | 2200 | 1954 | ||

| Peterborough | 1995 | 2000 | 1775 | ||

| Quebec City | 1125 | 1048 | 920 | ||

| Regina | 1325 | 1176 | 1075 | ||

| Sarnia | 1699 | 1350 | 975 | N/A | |

| Saskatoon | 1500 | 1222 | 1150 | ||

| Sault Ste. Marie | 1400 | 1400 | N/A | ||

| Scarborough | 2499 | N/A | N/A | ||

| Sherbrooke | 1098 | 1100 | N/A | ||

| St. Catharines | 1795 | 1825 | 1450 | ||

| St. John’s | 1600 | 1200 | 1625 | ||

| Sudbury | 1650 | 1498 | 1375 | ||

| Surrey | 2275 | 2500 | 2200 | ||

| Thunder Bay | 1475 | 1462 | 1375 | ||

| Toronto | 2800 | 3000 | 2600 | ||

| Trois-Rivieres | 1048 | 1150 | 930 | ||

| Vancouver | 3500 | 3785 | 3151 | ||

| Vaughan | 2650 | 2650 | 2200 | ||

| Victoria | 2725 | 2600 | 2950 | ||

| Waterloo | 2150 | 2300 | 2300 | ||

| Welland | 1600 | 1695 | 1350 | ||

| Whitehorse | 2425 | N/A | N/A | ||

| Windsor | 1575 | 1900 | 1600 | ||

| Winnipeg | 1285 | 1495 | 1295 | ||

| Kanata | 1949 | 2000 | 1850 |

In the 2 bedroom condo and apartment market, we’re seeing a similar story play out as in the 1 bedrooms with large cities experiencing rent cuts and smaller cities making rent gains. Similar to 1 beds, there are quite a few smaller Canadian cities making MoM gains such as Sarnia (+25.7%), Saskatoon (+22.7%) and St. John’s (33.3%). Around the GTA, rents are down almost across the board this month with Milton (-23.8%) leading the rent drops putting it in YoY decline of -13%. Montreal (+7.5%) was the only mega city making gains in this category.

| City | One Bedroom Median Rent |

Last Quarter Rent (Jan 2023) | Last Year Rent (Mar 2022) | Month-Over-Month Rent % Change |

Year-Over-Year Rent % Change |

|---|---|---|---|---|---|

| Abbotsford | 1475 | 1450 | 1550 | ||

| Barrie | 1600 | 1450 | N/A | ||

| Belleville | 1400 | 1600 | 1600 | ||

| Brampton | 1500 | 1500 | 1400 | ||

| Brandon | 825 | 850 | N/A | ||

| Brantford | 1525 | 1600 | N/A | ||

| Burlington | 2200 | 2000 | 1850 | ||

| Burnaby | 1900 | N/A | N/A | ||

| Calgary | 1370 | 1250 | 1050 | ||

| Charlottetown* | 1450 | 1350 | N/A | ||

| Coquitlam | 2032 | N/A | N/A | ||

| Edmonton | 1050 | 1035 | 985 | ||

| Etobicoke | 2225 | 2175 | 1550 | ||

| Fredericton | 1100 | 1100 | 1095 | ||

| Guelph | 1600 | 1750 | 1750 | ||

| Halifax | 1750 | 1550 | 1299 | ||

| Hamilton | 1700 | 1650 | 1450 | ||

| Kelowna | 1550 | 1639 | 1600 | ||

| Kingston | 1550 | 1500 | 1322 | ||

| Kitchener | 1784 | 1875 | 1650 | ||

| Laval | 1325 | 1500 | 1240 | ||

| Lethbridge | 1000 | 1000 | 900 | ||

| London | 1395 | 1372 | 1510 | ||

| Markham | 1725 | 1650 | 1800 | ||

| Milton | 1650 | 1550 | 1300 | ||

| Mississauga | 1699 | 1800 | 1869 | ||

| Moncton | 1200 | 1200 | 900 | ||

| Montreal | 1395 | 1440 | 1200 | ||

| Nanaimo | 1512 | 1535 | N/A | ||

| Niagara Falls | 1450 | 1450 | 1374 | ||

| North York | 1800 | 2145 | 1800 | ||

| North Vancouver | 2425 | N/A | N/A | ||

| Oakville | 2350 | 2300 | 2225 | ||

| Oshawa | 1500 | 1800 | 1300 | ||

| Ottawa | 1650 | 1800 | 1600 | ||

| Peterborough | 1595 | 1550 | 1325 | ||

| Quebec City | 950 | 1095 | 762 | ||

| Regina | 1100 | 1026 | 920 | ||

| Richmond | 2100 | 1800 | N/A | ||

| Sarnia | 1258 | 1320 | 995 | ||

| Saskatoon | 1110 | 1050 | 950 | ||

| Sault Ste. Marie* | 1150 | 1275 | N/A | ||

| Sherbrooke | 875 | 775 | N/A | ||

| St. Catharines | 1500 | 1500 | 1350 | ||

| St. John’s | 1000 | 1322 | 1188 | ||

| Sudbury | 1250 | 1275 | N/A | ||

| Surrey | 1500 | 1500 | 1550 | ||

| Thunder Bay | 1200 | 1200 | 1012 | ||

| Toronto | 2200 | 2250 | 1950 | ||

| Trois-Rivieres | 745 | 780 | 575 | ||

| Vancouver | 2375 | 2450 | 2138 | ||

| Vaughan | 1800 | 2200 | 1800 | ||

| Victoria | 2000 | 2000 | 1900 | ||

| Waterloo | 1694 | 1997 | 1700 | ||

| Welland | 1420 | 1325 | 1600 | ||

| Whitehorse* | 1525 | 1450 | N/A | ||

| Windsor | 1300 | 1250 | 1198 | ||

| Winnipeg | 1090 | 982 | 975 |

Last month this category saw overall declines in rents, however this month we’re seeing many gainers in this category. Notable jumps in this category were Brantford (+23.6%), Scarborough (+24.2%), Vaughan (+27.5%) and Charlottetown (+24.3%). Notable declines were experienced in Markham (-13.2%), Milton (-18.4%) and Sherbrooke (-19.1%). Once again, more pressure to downsize may be causing the gains in the typically more affordable cities.

| City | ONE Bedroom Median Rent |

Last Month Rent (Dec 2022) |

Last Year Rent (Dec 2021) |

Month-Over-Month Rent % Change |

Year-Over-Year Rent % Change |

|---|---|---|---|---|---|

| Abbotsford* | 1650 | 1672 | N/A | ||

| Belleville | 1600 | 1500 | N/A | ||

| Brampton | 1950 | N/A | N/A | ||

| Brandon* | 838 | 800 | N/A | ||

| Brantford | 1625 | 1250 | N/A | ||

| Burlington | 2175 | 2325 | N/A | ||

| Calgary | 1500 | 1500 | 1199 | ||

| Charlottetown | 1420 | 1200 | 1150 | ||

| Corner Brook* | 800 | N/A | N/A | ||

| Edmonton | 1095 | 1050 | 900 | ||

| Etobicoke | 2222 | 2415 | N/A | ||

| Fredericton | 1025 | 1175 | 1300 | N/A | |

| Guelph | 1800 | 1838 | N/A | ||

| Halifax | 1595 | 1595 | 1532 | ||

| Hamilton | 1650 | 1700 | N/A | ||

| Kelowna | 1850 | 1782 | N/A | ||

| Kingston | 1550 | 1550 | 1542 | ||

| Kitchener | 1900 | 1898 | 1450 | ||

| Laval* | 1510 | 1440 | 1295 | ||

| Lethbridge* | 1050 | 1025 | 936 | ||

| London | 1372 | 1400 | N/A | ||

| Markham | 2175 | 2349 | N/A | ||

| Milton | 1600 | N/A | N/A | ||

| Mississauga | 2050 | 2295 | 2100 | ||

| Moncton | 1115 | 1050 | 1088 | ||

| Montreal | 1445 | 1500 | 1355 | N/A | |

| Niagara Falls | 1500 | N/A | N/A | ||

| North York | 2173 | 2416 | 1910 | ||

| Oakville | 2400 | 2425 | N/A | ||

| Oshawa | 1852 | 1599 | N/A | ||

| Ottawa | 1835 | 1850 | 1700 | ||

| Peterborough | 1500 | 1500 | N/A | ||

| Quebec City | 1095 | 1008 | 860 | ||

| Regina | 1075 | 950 | 950 | ||

| Sarnia | 1350 | 1380 | N/A | ||

| Saskatoon | 1000 | 880 | 950 | ||

| Sault Ste. Marie | 1250 | 1150 | N/A | ||

| Scarborough | 2136 | 1799 | 1590 | ||

| Sherbrooke | 775 | 915 | N/A | ||

| St. Catharines | 1500 | 1595 | 1375 | ||

| St. John’s* | 1395 | N/A | N/A | ||

| Sudbury | 1288 | 1175 | N/A | ||

| Summerside* | 1195 | N/A | N/A | ||

| Surrey* | 1600 | 1850 | 1590 | ||

| Thunder Bay | 1200 | 1000 | N/A | ||

| Toronto | 2300 | 2500 | 1912 | ||

| Trois-Rivieres* | 780 | N/A | N/A | ||

| Vancouver | 2495 | 2700 | 2150 | ||

| Victoria | 2100 | 2139 | 1525 | ||

| Waterloo | 2000 | N/A | N/A | ||

| Welland | 1312 | 1300 | 1400 | ||

| Windsor | 1250 | 1100 | 1175 | ||

| Winnipeg | 1000 | 1046 | 1010 |

The 1 bedroom condo and apartment market continues to slow down with Toronto (-8%) only going negative to $2300 eroding last month’s 3.3% gain and Vancouver (-7.6%) continuing its negative trend, down to $2495 with a larger decline than last month. 20 cities on the other hand, actually saw gains in the 1 bedroom category. We’re starting to see larger markets continuing to show stabilization while smaller markets face growing demand of renters. Tighter rental markets in smaller areas could possibly be due to movement of people out of high rent areas of the major metropolitans in search of lower rent.