Rent stabilization for the winter months:

Continuing from our rent report in October 2022, rent stabilization is occurring with the month over month declines across the majority of markets in Canada. Monthly rent is down 5.48% vs. October 2022. However the rent is up approximately 18% vs. November 2021. Rent stabilization, in combination with the new affordability standards in Canada puts investors and landlords in a levelling out period.

Affordability standards have changed:

The age-old rule of a family not spending more than 30% of their household income on rent will be changed, as the average family in Canada will now spend over 35% (down from 36% in Oct 2022) of their income on rent, with that number rising upwards of 45% plus of their income within hot rental markets in the country such as Vancouver, Victoria, Kelowna, and Toronto.

The average median rent amount across Canada was $2,140/month, with Ontario ($2,400), British Columbia ($2,400), and Yukon ($2,150) coming in as the top 3 provinces.

The more affordable cities for families in Ontario include Sault Ste. Marie, Sudbury, Windsor all being under 35% of household income, while others like Ottawa, Kingston, London, Brantford, Belleville, Guelph and Hamilton are still on the affordable end for families, with rent under 45% of household income.

What to expect for the rest of the year:

Rent declines could be the normal seasonal pattern as prices tend to decline in the winter months and stay that way until at least after the holidays. However, further interest rate hikes, combined with continuing inflation, will continue to keep the pressure on renters as more mortgages come up for renewal with less buying power available. In our Canada-wide rent report we look at recent market trends, overall rent rates, and affordability metrics to provide a near real-time analysis of the state of the Canadian rental market.

Rent stabilization for the winter months:

Continuing from our rent report in October 2022, rent stabilization is occurring with the month over month declines across the majority of markets in Canada. Monthly rent is down 5.48% vs. October 2022. However the rent is up approximately 18% vs. November 2021. Rent stabilization, in combination with the new affordability standards in Canada puts investors and landlords in a levelling out period.

Affordability standards have changed:

The age-old rule of a family not spending more than 30% of their household income on rent will be changed, as the average family in Canada will now spend over 35% (down from 36% in Oct 2022) of their income on rent, with that number rising upwards of 45% plus of their income within hot rental markets in the country such as Vancouver, Victoria, Kelowna, and Toronto.

The average median rent amount across Canada was $2,140/month, with Ontario ($2,400), British Columbia ($2,400), and Yukon ($2,150) coming in as the top 3 provinces.

The more affordable cities for families in Ontario include Sault Ste. Marie, Sudbury, Windsor all being under 35% of household income, while others like Ottawa, Kingston, London, Brantford, Belleville, Guelph and Hamilton are still on the affordable end for families, with rent under 45% of household income.

What to expect for the rest of the year:

Rent declines could be the normal seasonal pattern as prices tend to decline in the winter months and stay that way until at least after the holidays. However, further interest rate hikes, combined with continuing inflation, will continue to keep the pressure on renters as more mortgages come up for renewal with less buying power available. In our Canada-wide rent report we look at recent market trends, overall rent rates, and affordability metrics to provide a near real-time analysis of the state of the Canadian rental market.

income to rent

income to rent

income to rent

income to rent

income to rent

income to rent

| City | Individual Affordability | Affordability Ratio | Household Affordability | Affordability Ratio |

|---|---|---|---|---|

| Toronto | 123% | 0.8 : 1 | 69% | 1.5 : 1 |

| Vancouver | 120% | 0.8 : 1 | 64% | 1.6 : 1 |

| Kitchener/Waterloo/Cambridge | 87% | 1.2 : 1 | 45% | 2.2 : 1 |

| Victoria | 84% | 1.2 : 1 | 57% | 1.8 : 1 |

| Abbotsford | 80% | 1.3 : 1 | 44% | 2.3 : 1 |

| Kelowna | 77% | 1.3 : 1 | 48% | 2.1 : 1 |

| Niagara/St. Catherines | 76% | 1.3 : 1 | 41% | 2.4 : 1 |

| Guelph | 76% | 1.3 : 1 | 41% | 2.4 : 1 |

| Halifax | 76% | 1.3 : 1 | 43% | 2.3 : 1 |

| Hamilton | 76% | 1.3 : 1 | 41% | 2.5 : 1 |

| Peterborough | 73% | 1.4 : 1 | 43% | 2.3 : 1 |

| Montreal | 72% | 1.4 : 1 | 42% | 2.4 : 1 |

| Ottawa | 71% | 1.4 : 1 | 33% | 3.1 : 1 |

| Belleville | 70% | 1.4 : 1 | 42% | 2.4 : 1 |

| Kingston | 68% | 1.5 : 1 | 39% | 2.5 : 1 |

| Calgary | 67% | 1.5 : 1 | 34% | 2.9 : 1 |

| London | 65% | 1.5 : 1 | 42% | 2.4 : 1 |

| Brantford | 59% | 1.7 : 1 | 43% | 2.3 : 1 |

| Sarnia | 59% | 1.7 : 1 | 42% | 2.4 : 1 |

| Sault Ste. Marie | 55% | 1.8 : 1 | 29% | 3.4 : 1 |

| Windsor | 53% | 1.9 : 1 | 36% | 2.8 : 1 |

| Moncton | 53% | 1.9 : 1 | 36% | 2.8 : 1 |

| Trois-Rivières | 52% | 1.9 : 1 | 38% | 2.6 : 1 |

| Winnipeg | 52% | 1.9 : 1 | 32% | 3.2 : 1 |

| Sudbury | 52% | 1.9 : 1 | 35% | 2.8 : 1 |

| Sherbrooke | 47% | 2.1 : 1 | 28% | 3.6 : 1 |

| Edmonton | 46% | 2.2 : 1 | 27% | 3.7 : 1 |

| Thunder Bay | 45% | 2.2 : 1 | 28% | 3.5 : 1 |

| Regina | 42% | 2.4 : 1 | 25% | 4.1 : 1 |

| Saskatoon | 40% | 2.5 : 1 | 29% | 3.4 : 1 |

The trend continues with rental rates across Canada for individuals as well as multi-income families have become increasingly less affordable throughout 2022.

Edmonton, Thunder Bay, Regina and Saskatoon rank as the most affordable cities while Toronto, Vancouver and Kitchener Waterloo rank as most unaffordable regions.

For individuals looking to rent on their own, the most unaffordable cities include Toronto (123%), Vancouver (120%), Kitchener/Waterloo (84%), Victoria (84%) and Abbotsford (80%).

The most affordable cities to rent on your own include Saskatoon (40%), Regina (42%), Thunder Bay (45%), Edmonton (46%) and Sherbrooke (47%) based on median income.For families, the lease affordable cities trend continues with Toronto (69%), Vancouver (64%), Victoria (57%), Kelowna (48%), and Kitchener/Waterloo (45%) of household income. The least affordable cities are Regina (25%), Edmonton (27%), Thunder Bay (28%), Sherbrooke (28%) and Saskatoon (29%).

| Province | Median Rent (Nov 2022) | Median Rent (Oct 2022) | Median Rent (2021) | Month-Over-Month Rent % Change | Year-Over-Year Rent % Change |

|---|---|---|---|---|---|

| Alberta | $1,795 | $1,800 | $1,300 | -0.3% | 38.1% |

| British Columbia | $2,400 | $2,700 | $2,400 | -11.1% | 0.0% |

| Manitoba | $1,545 | $1,650 | $1,280 | -6.4% | 20.7% |

| New Brunswick | $1,500 | $1,325 | $1,200 | 13.2% | 25.0% |

| Newfoundland | $1,600 | $1,600 | $1,225 | 0.0% | 30.6% |

| Nova Scotia | $2,100 | $1,995 | $1,568 | 5.3% | 33.9% |

| Northwest Territories | $2,060 | $1,680 | $1,399 | 22.6% | N/A |

| Ontario | $2,400 | $2,550 | $2,250 | -5.9% | 6.7% |

| Prince Edward Island | $1,700 | $1,940 | $1,575 | -12.4% | N/A |

| Quebec | $1,450 | $1,472 | $1,350 | -1.5% | 7.4% |

| Saskatchewan | $1,300 | $1,200 | $1,100 | 8.3% | 18.2% |

| Yukon | $2,150 | $2,275 | N/A | N/A | N/A |

| All Canada | $2,140 | $2,264 | $1,814 | -5.5% | 18.0% |

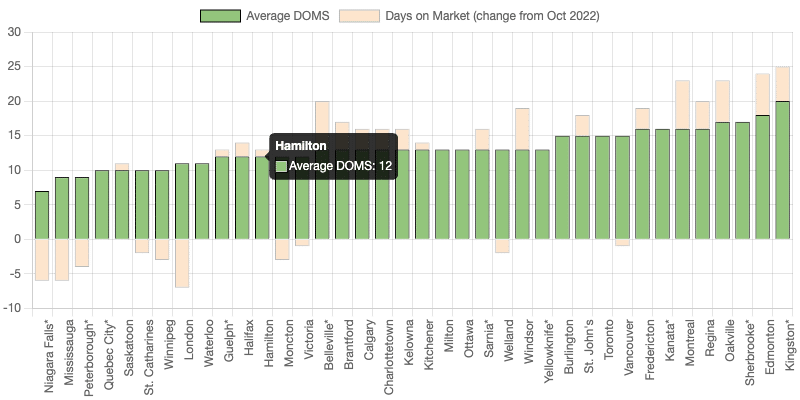

Markets across the country are continuing to see high demand for rental properties – which means relatively low average days-on-market (DOM). Overall, from last month we saw days on market increase for most of the cities across the country showing signs of a definite slowdown in the rental market – however still showing very low days on market overall (with 20 DOM being the highest average number). Only 10 cities of the 38 saw declines in DOM. The biggest change for fast renter turnover was in London which saw listing DOM down 7 days sooner than last month. Montreal on the other hand saw listings sitting for 7 days longer. In Ontario, Niagara Falls, Mississauga and Peterborough led the country with just under 10 DOM at 7 days, 10 and 10 days respectively. Heading east, Halifax and Moncton saw listings quickly rented within 12 days. The two most expensive markets of Toronto and Vancouver both took an average of 15 DOM. In the prairies, Saskatoon and Winnipeg saw steady demand at 10 DOM. With most markets taking 2 weeks or less, rentals listings continue to see high demand and quick turnover.

| City | Three Bedroom Median Rent | Last Month Rent (Oct 2022) | Last Year Rent (Oct 2021) | Month-Over-Month Rent % Change | Year-Over-Year Rent % Change |

|---|---|---|---|---|---|

| Abbotsford | 2500 | 2500 | N/A | ||

| Belleville | 2300 | 2500 | 2100 | ||

| Brampton | 2945 | 2999 | 2650 | ||

| Brandon* | 1450 | N/A | N/A | ||

| Brantford | 2495 | 2500 | 2299 | ||

| Burlington | 3100 | 3200 | 3000 | ||

| Calgary | 2245 | 2300 | 1800 | ||

| Charlottetown | 2200 | 2250 | N/A | ||

| Edmonton | 1775 | 1795 | 1450 | ||

| Etobicoke* | 3200 | 3000 | 3000 | ||

| Fredericton | 1980 | 1975 | N/A | ||

| Guelph | 2700 | 2800 | 2448 | ||

| Halifax | 2500 | 2500 | 2200 | ||

| Hamilton | 2625 | 2700 | 2500 | ||

| Kelowna | 3000 | 2900 | 2950 | ||

| Kingston | 2500 | 2500 | 2500 | ||

| Kitchener | 2800 | 2895 | 2472 | ||

| Laval* | 2100 | 1800 | N/A | ||

| Lethbridge* | 1488 | 1425 | N/A | ||

| London | 2500 | 2500 | 2399 | ||

| Markham | 2998 | 2988 | 2880 | ||

| Milton | 3000 | 2999 | 2800 | ||

| Mississauga | 3100 | 3200 | 2800 | ||

| Moncton | 1900 | 1775 | 1600 | ||

| Montreal | 2225 | 2000 | 1750 | ||

| Nepean* | 2300 | 2399 | 2250 | ||

| Niagara Falls | 2400 | 2375 | 2280 | ||

| Oakville | 3400 | 3495 | 3200 | ||

| Oshawa | 2595 | 2595 | 2447 | ||

| Ottawa | 2397 | 2450 | 2300 | ||

| Peterborough | 2500 | 2700 | 2275 | ||

| Regina | 1600 | 1800 | 1490 | ||

| Sarnia | 2550 | 2375 | 2700 | ||

| Saskatoon | 1800 | 1950 | 1464 | ||

| Sault Ste. Marie | 1750 | 1850 | N/A | ||

| Scarborough* | 2899 | 2800 | 2345 | ||

| Sherbrooke | 1475 | 1500 | N/A | ||

| St. Catharines | 2295 | 2395 | 2150 | ||

| St. John’s | 1850 | 1872 | 1675 | ||

| Sudbury | 2125 | 2400 | 1800 | ||

| Surrey | 3000 | 3100 | 2250 | ||

| Thunder Bay | 1895 | 1700 | 1600 | ||

| Toronto | 3900 | 4200 | 3090 | ||

| Trois-Rivieres | 1542 | N/A | N/A | ||

| Vancouver | 4000 | 4375 | 2875 | ||

| Vaughan | 3400 | 3495 | 3100 | ||

| Victoria | 3675 | 3500 | 2750 | ||

| Waterloo | 2974 | 3000 | 2650 | ||

| Welland | 2150 | 2250 | 2100 | ||

| Whitehorse | 2100 | N/A | N/A | ||

| Windsor | 2100 | 2075 | 1950 | ||

| Winnipeg | 1795 | 1850 | 1600 | ||

| Corner Brook* | 1300 | N/A | N/A |

Montreal (11.3%) and Thunder Bay (11.5%) saw notable increases in rent in this category bringing down all 3 bedroom rents to $2,225 and $1,895 respectively.Most cities however, saw declines such as Regina (-11.1%) and Sudbury (-11.5%) but this category overall was less effected than the 1 and 2 bedroom categories in terms of overall rent fluctuations.

| City | Three Bedroom Median Rent |

Last Month Rent (Oct 2022) |

Last Year Rent (Oct 2021) |

Month-Over-Month Rent % Change |

Year-Over-Year Rent % Change |

|---|---|---|---|---|---|

| Abbotsford | 2500 | 2500 | N/A | ||

| Belleville | 2400 | 2500 | 2200 | ||

| Brampton | 2995 | 3000 | 2600 | ||

| Brandon* | 1455 | N/A | N/A | ||

| Brantford | 2498 | 2500 | 2300 | ||

| Burlington | 3100 | 3250 | 3100 | ||

| Calgary | 2295 | 2400 | 1900 | ||

| Charlottetown | 2200 | 2250 | N/A | N/A | |

| Corner Brook* | 1498 | N/A | N/A | ||

| Edmonton | 1800 | 1849 | 1598 | ||

| Fredericton | 2175 | 2100 | 1800 | N/A | |

| Guelph | 2725 | 2750 | 2245 | ||

| Halifax | 2500 | 2500 | 2275 | ||

| Hamilton | 2625 | 2650 | 2500 | ||

| Kelowna | 2975 | 2900 | N/A | ||

| Kingston | 2500 | 2600 | 2500 | ||

| Kitchener | 2800 | 2950 | 2495 | ||

| Lethbridge* | 1500 | 1425 | 1300 | ||

| London | 2500 | 2595 | 2372 | ||

| Markham | 2995 | 3000 | 2880 | ||

| Milton | 3000 | 3000 | 2750 | ||

| Mississauga | 3148 | 3195 | 2700 | ||

| Moncton | 1900 | 1950 | 1600 | ||

| Montreal | 2374 | 2500 | 2025 | ||

| Nepean* | 2300 | 2397 | 2350 | ||

| Niagara Falls | 2400 | 2350 | 2299 | ||

| North York* | 2999 | 2675 | 2700 | ||

| Oakville | 3400 | 3400 | 3200 | ||

| Oshawa | 2595 | 2525 | 2365 | ||

| Ottawa | 2400 | 2500 | 2300 | ||

| Peterborough | 2500 | 2700 | 2275 | ||

| Regina | 1600 | 1800 | 1490 | ||

| Sarnia | 2600 | 2350 | 2700 | ||

| Saskatoon | 1850 | 1950 | 1658 | ||

| Sault Ste. Marie | 1750 | 1850 | N/A | ||

| Scarborough* | 2899 | 2800 | 2320 | ||

| St. Catharines | 2300 | 2400 | 2348 | ||

| St. John’s | 2000 | 1995 | N/A | ||

| Sudbury | 2350 | 2400 | 1900 | ||

| Surrey | 2950 | 3000 | 2322 | ||

| Thunder Bay | 1800 | 1700 | 1475 | ||

| Toronto | 4182 | 4500 | 3270 | ||

| Vancouver | 3980 | 4500 | N/A | ||

| Vaughan | 3495 | 3600 | 3025 | ||

| Victoria | 3800 | 3500 | N/A | ||

| Waterloo | 3000 | 3199 | 2750 | ||

| Welland | 2198 | 2248 | N/A | ||

| Whitehorse | 2100 | 2600 | N/A | ||

| Windsor | 2100 | 2100 | 1950 | ||

| Winnipeg | 1795 | 1895 | 1500 |

Since 2021, parts of Northern Ontario saw some of the highest YoY increases in median 3 bedroom home rents. Sudbury (+23.7% YoY) saw a (-2.1%) decline MoM. In the west coast, Victoria saw strong MoM gains of 8.6%, reaching $3800 in median rent. In Ontario, 3 bedroom home rents appear to be stabilizing with slight declines MoM in Hamilton (-0.9%), Brantford (-0.1%), Belleville (-4%), Burlington (-4.6%), Kitchener (-5.1%), Waterloo (-6.2%) and Toronto (-7.1%).

| City | Two Bedroom Median Rent |

Last Month Rent (Oct 2022) |

Last Year Rent (Oct 2021) |

Month-Over-Month Rent % Change |

Year-Over-Year Rent % Change |

|---|---|---|---|---|---|

| Abbotsford | $1,600 | $1,900 | N/A | ||

| Belleville | $1,937 | $1,800 | $1,600 | ||

| Brampton | $1,900 | $1,925 | $1,650 | ||

| Brandon | $1,025 | N/A | N/A | ||

| Brantford | $1,850 | $1,900 | N/A | ||

| Burlington | $2,750 | $2,920 | $2,500 | ||

| Calgary | $1,650 | $1,725 | $1,314 | ||

| Charlottetown | $1,700 | $1,900 | N/A | ||

| Edmonton | $1,354 | $1,397 | $1,215 | ||

| Etobicoke* | $2,500 | $2,500 | $2,172 | ||

| Fredericton | $1,475 | $1,550 | N/A | ||

| Guelph | $2,325 | $2,500 | N/A | ||

| Halifax | $2,000 | $1,925 | $1,850 | ||

| Hamilton | $2,172 | $2,197 | $1,900 | ||

| Kanata* | $2,000 | $2,300 | $1,888 | ||

| Kelowna | $2,095 | $2,250 | $2,200 | ||

| Kingston | $1,972 | $2,195 | $1,799 | ||

| Kitchener | $2,200 | $2,264 | $1,925 | ||

| Laval* | $1,290 | $1,500 | N/A | ||

| Lethbridge | $1,268 | $1,212 | $1,195 | ||

| London | $2,000 | $2,082 | $1,855 | ||

| Markham | $2,250 | $1,975 | $1,750 | ||

| Milton | $2,150 | $2,600 | $1,800 | ||

| Mississauga | $2,274 | $2,350 | $2,154 | ||

| Moncton | $1,262 | $1,300 | $1,300 | ||

| Montreal | $1,675 | $1,742 | $1,595 | ||

| Nepean* | $1,950 | $2,000 | $1,850 | ||

| Niagara Falls | $1,700 | $1,800 | $1,550 | ||

| North York | $2,569 | $2,644 | $2,298 | ||

| Oakville | $2,700 | $2,725 | $2,498 | ||

| Oshawa | $1,850 | $1,914 | $1,850 | ||

| Ottawa | $2,192 | $2,200 | $1,900 | ||

| Peterborough | $2,000 | $2,175 | $1,808 | ||

| Quebec City | $1,050 | $1,045 | $915 | ||

| Regina | $1,150 | $1,214 | $1,035 | ||

| Sarnia | $1,700 | $1,585 | N/A | ||

| Saskatoon | $1,200 | $1,250 | $1,175 | ||

| Sault Ste. Marie | $1,500 | $1,472 | N/A | ||

| Scarborough* | $2,376 | $2,350 | $1,845 | ||

| Sherbrooke | $1,162 | $1,095 | N/A | ||

| St. Catharines | $1,795 | $1,750 | $1,525 | ||

| St. John’s | $1,298 | $1,295 | $1,300 | ||

| Sudbury | $1,500 | $1,500 | $1,495 | ||

| Summerside* | $1,500 | N/A | N/A | ||

| Surrey | $2,050 | $2,475 | N/A | ||

| Thunder Bay | $1,488 | $1,700 | $1,375 | ||

| Toronto | $2,962 | $2,995 | $2,600 | ||

| Trois-Rivieres* | $1,270 | N/A | N/A | ||

| Vancouver | $3,526 | $3,600 | $3,025 | ||

| Vaughan | $2,575 | $2,600 | $2,100 | ||

| Waterloo | $2,274 | $2,198 | $2,272 | ||

| Welland | $1,700 | $1,738 | $1,475 | ||

| Whitehorse | $2,100 | N/A | N/A | ||

| Windsor | $1,800 | $1,700 | $1,650 | ||

| Winnipeg | $1,495 | $1,450 | $1,300 | ||

| Yellowknife* | $2,010 | $1,675 | $1,740 | ||

| Corner Brook* | $1,200 | N/A | N/A | ||

| Mount Pearl* | $1,050 | N/A | N/A |

In British Columbia’s lower mainland, Surrey ($2050) and Abbotsford ($1600) saw the largest declines in the 2 Bedroom section for all housing types of (-17.2%) and (-15.8%) respectively MoM. Kingston (-10.2%) and Thunder Bay (-12.5%) were other notable drops in Ontario. Markham (+13.9%), Sarnia (+7.3%) and Windsor (+5.9%) led the way in monthly gains.

| City | Two Bedroom Median Rent |

Last Month Rent (Oct 2022) |

Last Year Rent (Oct 2021) |

Month-Over-Month Rent % Change |

Year-Over-Year Rent % Change |

|---|---|---|---|---|---|

| Abbotsford | 1900 | 1925 | N/A | ||

| Belleville | 1750 | 1725 | 1600 | ||

| Brandon | 1000 | N/A | N/A | ||

| Brantford | 1800 | 1850 | N/A | ||

| Burlington | 2832 | 2700 | 2500 | ||

| Calgary | 1800 | 1885 | 1450 | ||

| Charlottetown | 1595 | 1900 | N/A | ||

| Edmonton | 1400 | 1450 | 1200 | ||

| Fredericton | 1450 | 1550 | N/A | ||

| Guelph | 2350 | 2500 | N/A | ||

| Halifax | 1998 | 1725 | 1850 | ||

| Hamilton | 2150 | 1999 | 1874 | ||

| Kelowna | 2125 | 2250 | 2124 | ||

| Kingston | 1972 | 1999 | 1725 | ||

| Kitchener | 2200 | 2275 | 1975 | ||

| Lethbridge* | 1295 | 1322 | N/A | ||

| London | 1999 | 2070 | 1772 | ||

| Markham | 2598 | 2800 | N/A | ||

| Milton* | 2625 | 2700 | 2300 | ||

| Mississauga | 2750 | 2900 | 2200 | ||

| Moncton | 1250 | 1300 | 1300 | ||

| Montreal | 1675 | 1750 | 1598 | ||

| Nepean* | 1950 | N/A | 1850 | ||

| Niagara Falls | 1645 | 1730 | N/A | ||

| North York* | 2742 | 2900 | 2325 | ||

| Oakville | 2700 | 2800 | 2300 | ||

| Oshawa | 2125 | 1950 | 1858 | ||

| Ottawa | 2200 | 2175 | 1954 | ||

| Peterborough | 2000 | 2175 | 1775 | ||

| Quebec City | 1048 | 1035 | 920 | ||

| Regina | 1176 | 1200 | 1075 | ||

| Sarnia* | 1350 | 1575 | N/A | ||

| Saskatoon | 1222 | 1450 | 1150 | ||

| Sault Ste. Marie* | 1400 | 1470 | N/A | ||

| Sherbrooke | 1100 | 1095 | N/A | ||

| St. Catharines | 1825 | 1750 | 1450 | ||

| St. John’s | 1200 | 1225 | N/A | ||

| Sudbury | 1498 | 1500 | N/A | ||

| Surrey | 2500 | 2599 | N/A | ||

| Thunder Bay | 1462 | 1688 | 1375 | ||

| Toronto | 3000 | 2995 | 2600 | ||

| Trois-Rivieres* | 1150 | 938 | 930 | ||

| Vancouver | 3785 | 3900 | 3151 | ||

| Vaughan | 2650 | 2600 | 2200 | ||

| Victoria | 2600 | 2600 | N/A | ||

| Waterloo | 2300 | 2198 | N/A | ||

| Welland | 1695 | 1695 | N/A | ||

| Windsor | 1900 | 1575 | 1600 | ||

| Winnipeg | 1495 | 1500 | 1295 |

Areas such as London (-3.4%) are continuing the downward trend in the 2 bedroom condo/apartment segment with a drop to $2,000. The biggest MoM drop in this class was seen in Charlottetown (-16.1% ) where rents fell to $1,595. Year-over-year Charlottetown is still 10% higher. Areas seeing significant MoM gains are few with Halifax (15.8%) leading with a MoM gain to $1,998 and up 8% since last year along with Windsor (20.6%) up to $1,900 from last month’s $938. The big jump in Windsor could possibly due to larger 2 bedroom condo or apartment units coming on the rental market in the last month.

| City | One Bedroom Median Rent |

Last Month Rent (Oct 2022) |

Last Year Rent (Oct 2021) |

Month-Over-Month Rent % Change |

Year-Over-Year Rent % Change |

|---|---|---|---|---|---|

| Brantford | 1295 | 1675 | 1499 | ||

| Charlottetown | 1086 | 1400 | N/A | ||

| Mississauga | 1800 | 2200 | 1637 | ||

| Saskatoon | 900 | 1100 | 950 | ||

| Niagara Falls | 1345 | 1598 | N/A | ||

| Sault Ste. Marie | 1175 | 1310 | N/A | ||

| Kelowna | 1650 | 1838 | N/A | ||

| Fredericton | 1200 | 1275 | N/A | ||

| Burlington | 2150 | 2250 | 1975 | ||

| Guelph | 1850 | 1912 | N/A | ||

| Kingston | 1500 | 1550 | 1549 | ||

| Ottawa | 1758 | 1800 | 1600 | ||

| Sarnia | 1350 | 1372 | N/A | ||

| Etobicoke* | 2200 | 2225 | 2025 | ||

| Brampton | 1500 | 1500 | 1422 | ||

| Hamilton | 1650 | 1650 | 1472 | ||

| Moncton | 1050 | 1050 | 1200 | ||

| Oshawa | 1599 | 1599 | 1600 | ||

| Scarborough | 1610 | 1610 | 1350 | ||

| Kitchener | 1850 | 1848 | 1592 | ||

| Calgary | 1262 | 1250 | 1100 | ||

| Montreal | 1500 | 1465 | 1262 | ||

| Laval* | 1440 | 1400 | N/A | ||

| Edmonton | 1000 | 962 | 950 | ||

| Regina | 987 | 949 | 894 | ||

| Halifax | 1500 | 1425 | 1450 | ||

| London | 1400 | 1322 | 1280 | ||

| North York | 2350 | 2200 | 1695 | ||

| Markham* | 1900 | 1700 | 1412 | ||

| St. Catharines | 1575 | 1400 | 1422 | ||

| Quebec City | 1008 | 875 | 823 | ||

| Abbotsford | 1300 | 1350 | N/A | ||

| Sudbury | 1225 | 1250 | 1175 |

Niagara Falls (-22.7%) and Fredericton (-22.4%) saw the highest MoM declines in all 1 Bed rents with $1,345 and $1,200 respectively. Across the board this category saw overall declines in rents since last month. Notable jumps in this category were Sherbrooke (21.6%) and Quebec City (15.2%) where rents jumped to $958 and $1,008 respectively.

| City | ONE Bedroom Median Rent |

Last Month Rent (Oct 2022) |

Last Year Rent (Oct 2021) |

Month-Over-Month Rent % Change |

Year-Over-Year Rent % Change |

|---|---|---|---|---|---|

| Belleville | 1500 | N/A | N/A | ||

| Brandon | 800 | N/A | N/A | ||

| Brantford* | 1250 | 1700 | 1499 | ||

| Burlington | 2325 | 2250 | 1988 | ||

| Calgary | 1500 | 1452 | 1199 | ||

| Charlottetown* | 1200 | 1400 | N/A | ||

| Edmonton | 1050 | 1018 | 950 | ||

| Etobicoke* | 2415 | 2276 | 2050 | ||

| Fredericton | 1175 | 1250 | N/A | ||

| Guelph | 1838 | 1875 | N/A | ||

| Halifax | 1595 | 1616 | 1450 | ||

| Hamilton | 1700 | 1695 | 1408 | ||

| Kelowna | 1782 | 1838 | 1700 | ||

| Kingston | 1550 | 1572 | 1500 | ||

| Kitchener | 1898 | 1870 | 1608 | ||

| Laval* | 1440 | 1400 | 1216 | ||

| London | 1400 | 1250 | 1280 | ||

| Mississauga | 2295 | 2400 | 1900 | ||

| Moncton | 1050 | 1025 | N/A | ||

| Montreal | 1500 | 1490 | 1275 | ||

| Oakville | 2425 | 2400 | 2050 | ||

| Ottawa | 1850 | 1835 | 1599 | ||

| Peterborough | 1500 | 1562 | 1400 | ||

| Quebec City | 1008 | 875 | 823 | ||

| Regina | 950 | 900 | 892 | ||

| Sarnia | 1380 | 1372 | N/A | ||

| Saskatoon | 880 | 1134 | 950 | ||

| Sault Ste. Marie | 1150 | 1310 | N/A | ||

| Sherbrooke | 915 | 788 | N/A | ||

| St. Catharines | 1595 | 1350 | 1495 | ||

| Sudbury | 1175 | 1250 | 1225 | ||

| Surrey | 1850 | 1800 | 1500 | ||

| Thunder Bay | 1000 | 1150 | 1300 | ||

| Toronto | 2500 | 2421 | 2048 | ||

| Vancouver | 2700 | 2750 | 2212 | ||

| Victoria | 2139 | 2188 | 1680 | ||

| Welland* | 1300 | 1350 | 1450 | ||

| Windsor | 1100 | 1100 | 992 | ||

| Winnipeg | 1046 | 1121 | 990 |

The 1 bedroom condo and apartment market appears to be slowing down with Toronto (3.3%) only adding a slight increase from last month to $2500 and Vancouver (-1.8%) continuing its negative trend down to $2700. We’re seeing a similar story play out across the country as seasonal trends may be helping to soften the demand that has been propelling rents to new heights every month. Saskatoon (-22.4%) is one which as experienced a heavier correction of -22.4% to $880 but still up by 7.4% YOY. This downtrend seems more likely to be a heavy effect of seasonality in that market. Overall, this category of rents appear to be stabilizing at least for the time being.

| City | Price per Sqft |

|---|---|

| Vancouver | |

| Toronto | |

| North York | |

| Victoria | |

| Etobicoke | |

| Burlington | |

| Oakville | |

| Vaughan | |

| Kitchener | |

| Scarborough | |

| Montreal | |

| Whitehorse* | |

| Guelph | |

| Surrey | |

| Hamilton | |

| Kanata* | |

| Markham | |

| Kingston | |

| St. Catharines | |

| Mississauga | |

| Kelowna | |

| Waterloo | |

| Belleville | |

| Halifax | |

| Milton | |

| Ottawa | |

| Peterborough | |

| Sarnia |

| City | Price per Sqft |

|---|---|

| Oshawa | |

| Brampton | |

| Sudbury | |

| Nepean | |

| Welland | |

| Brantford | |

| Niagara Falls | |

| Abbotsford | |

| London | |

| Calgary | |

| Laval | |

| Thunder Bay | |

| Windsor | |

| Winnipeg | |

| Charlottetown | |

| Saskatoon | |

| Sault Ste. Marie | |

| Quebec City | |

| Summerside* | |

| Fredericton | |

| Moncton | |

| Regina | |

| Edmonton | |

| Lethbridge | |

| St. John’s | |

| Trois-Rivieres | |

| Sherbrooke | |

| Corner Brook* |

Vancouver leads the country with highest average rent per square foot of $3.76/sq. ft, holding very steady from last month’s $3.74/sq. ft. For the majority of other areas, price per square foot saw declines. Toronto saw a decline of 4.1% MoM to $3.45/sq. ft down from $3.60/sq. ft last month. In the rest of Ontario, Hamilton is also down at $2.18/sq. ft, a decline of 3.1%. And Brantford at $1.78/sq. ft, from $1.88 last month, a decline of 5.3%.

| City | Price per Sqft |

|---|---|

| Peterborough | |

| Mississauga | |

| Burlington | |

| Markham | |

| Oakville | |

| Surrey | |

| St. John’s | |

| Victoria | |

| Regina | |

| Milton | |

| London | |

| Toronto | |

| Niagara Falls | |

| Nepean* | |

| Edmonton | |

| Kingston | |

| Windsor | |

| Calgary | |

| Halifax | |

| Welland | |

| Guelph | |

| Kelowna | |

| Brantford |

| City | Price per Sqft |

|---|---|

| Montreal* | |

| Lethbridge | |

| Oshawa | |

| St. Catharines | |

| Brampton | |

| Vancouver | |

| Waterloo | |

| Saskatoon | |

| Kitchener | |

| Hamilton | |

| Vaughan | |

| Belleville | |

| Sudbury | |

| Ottawa | |

| Sarnia | |

| Thunder Bay* | |

| Fredericton* | |

| Winnipeg | |

| Abbotsford | |

| Charlottetown | |

| Moncton | |

| Sault Ste. Marie* |

Peterborough and Mississauga experienced the highest drop in average rent by square foot in the house type with -14.8% and -10.4% respectively. In the Prairies, Saskatoon and Waterloo experienced the highest increase in this category with 11.7% and 6.1% respectively.

| City | Price per Sqft |

|---|---|

| Trois-Rivieres* | |

| Sherbrooke | |

| Halifax | |

| Windsor | |

| Kelowna | |

| Montreal | |

| Niagara Falls | |

| Oakville | |

| Ottawa | |

| Kingston | |

| Mississauga | |

| Quebec City | |

| Winnipeg | |

| Burlington | |

| Edmonton | |

| Toronto | |

| Regina | |

| Guelph | |

| Waterloo | |

| Hamilton | |

| Calgary | |

| London | |

| Etobicoke* | |

| Vancouver |

| City | Price per Sqft |

|---|---|

| Fredericton | |

| Brantford | |

| Saskatoon | |

| Scarborough* | |

| Vaughan* | |

| North York | |

| Surrey | |

| Markham | |

| Victoria | |

| Milton | |

| Kitchener | |

| Oshawa | |

| Belleville | |

| St. Catharines | |

| Sarnia | |

| Peterborough | |

| Welland | |

| Sudbury | |

| Charlottetown | |

| Thunder Bay | |

| St. John’s | |

| Moncton | |

| Laval* | |

| Lethbridge* |

The average rent by square foot in the Condos/Apartments class has come down in many regions with Toronto and Vancouver dropping by 2.1% and 8% respectively. Toronto is now at $3.74/sq. ft and Vancouver is at $4.01/sq. ft. Sherbrooke, Halifax and Windsor, Kelowna and Montreal have experienced rises of over 10% in rent by square foot.

Median rent vs. average

Median is used as a more accurate portrayal of market rent, as average rent can be skewed by extreme lows or highs in just a few properties within a market with a smaller data set of rentals.

Affordability

An analysis and comparison of affordability in major cities across the country. Affordability is calculated using median household income numbers along with median rent rates and mapping to a scale.

Family household

A family household or couple family is a family where the reference person has a married spouse or common-law partner in the family, regardless of whether or not the reference person also has children.

Individual household

An individual household is an individual who is not part of a census family, couple family, or lone-parent family. Persons not in census families may live with their married children or with their children who have children of their own. They may be living with a family to whom they are related or unrelated. They may also be living alone or with other non-family persons.

Vacancy

An analysis of vacancy rates across the province of Ontario.

Rent by square foot

Rent by square foot (sq. ft) is summarized by first calculating the rent per sq. ft cost of individual listings that contain square footage information, this is then averaged on a per-city basis.

Days on market

The average # of days a rental unit has been listed on the market, factoring in multiple listing websites.

With unique insights from affordability, days on market, rent rates by housing type, and rent rates from both large and tertiary, smaller markets, we believe that our report is the most comprehensive and accurate snapshot of the rental market in Canada to date.

Our analysis in this document is based on advertised properties for rent across multiple listing sites in Canada.

Our data within the report is manually analyzed, then aggregated using four of the top ten rental listing sites used nationally by landlords and investors. “All dwelling types” includes the following types of homes: rental apartments, condominium apartments, basement apartments, duplexes, individual units, townhomes and single detached houses. The “house” type includes single detached houses, duplex and townhomes. The “condo” type includes condominium apartments and rental apartments.

Where noted, cities that have an asterisk (*) next to them are calculated using a smaller sample size.

Median rent

Calculated using the total number of # of rentals across top listing sites and finding the median rent amount per building type, unit size, to get an accurate representation of the rental norm amounts per market.

Affordability methodology

Affordability for family households is calculated by comparing the average family household monthly income to the average monthly rent in the major cities. A rating to rank affordability was developed based on this ratio. The Golden Rule of 30% of income to rent played a role in determining the affordability of a city.

Rent Panda, in collaboration with Door Insight, have created a market-leading report outlining an accurate portrayal of the national rental market in Canada with key indicators of the current state and future state of the rental industry.

We strive to continually provide an up-to-date and accurate rental analysis for investors and landlords to inform the decision-making process for their investments.

About Rent Panda

Rent Panda is a tech-enabled Canadian real estate company. Our mission is to empower small landlords with innovative tools and services that make the landlording experience possible – helping small landlords effectively find tenants in Ontario. From a free listing platform for do-it-yourself landlords, to a white-glove leasing service for more passive landlords, Rent Panda offers the most comprehensive services in the industry, making it safer for all parties to rent. For more information visit www.rentpanda.ca or follow us on Instagram, Facebook and LinkedIn.

About Door Insight

Door Insight is a real estate intelligence platform that analyzes Canadian real estate data to make information accessible and digestible for consumers and professionals. Their mission is to arm Canadians with transparency and insights to make informed real estate decisions. Door Insight offers a leading Rent Estimator, insightful neighbourhood maps, and tools to aid in the due diligence process. For your Canadian real estate research needs visit https://doorinsight.com for more information.